stash invest tax documents

New York AUM 274141746800 Last Form ADV Filed. You received more than 10 in interest on your Stash Invest account.

Stash 1099 Tax Documents Youtube

Stash will email you when your tax forms become available.

. Sign up for Stash so you can start building wealth and improving your financial life. Copy or screenshot your account number and type of tax. GR16090826 adjusted for subsequent tax rate changes associated with the Tax Cuts and Jobs Act of 2017.

Investment Managers pursuant to the terms of the Investment Management. In TurboTax select the financial section that corresponds to your 1099 type. Stash Tax Forms Available.

Have 2021 tax documents shown up in anyones account yet. Copy or screenshot your account number and type of tax document is. If you have not received a 1099 form from Stash you should check your online Stash account to see if a 1099 form has been provided for you.

You should have tax documents from Stash if. You made a withdrawal from your Stash Retire IRA of 10 or more. I just checked my account and tax documents are finally available for 2019.

Stash Invest Promotion Get 20 bonus stock with this referral link. Firm Details for STASH INVEST Location. This form is sent to you by Stash if you earned more than 10 in dividends from EFTS or mutual funds OR if you earned any divided directly from a stock.

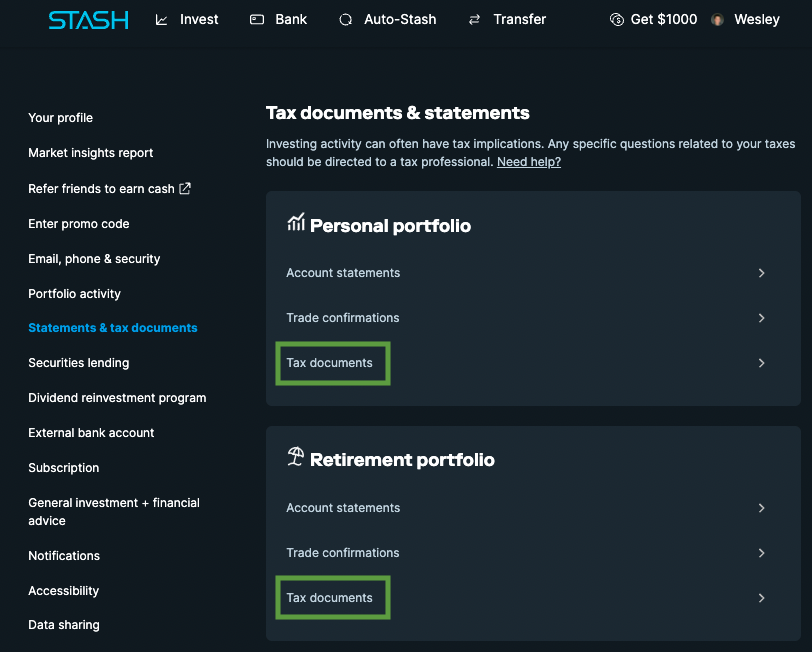

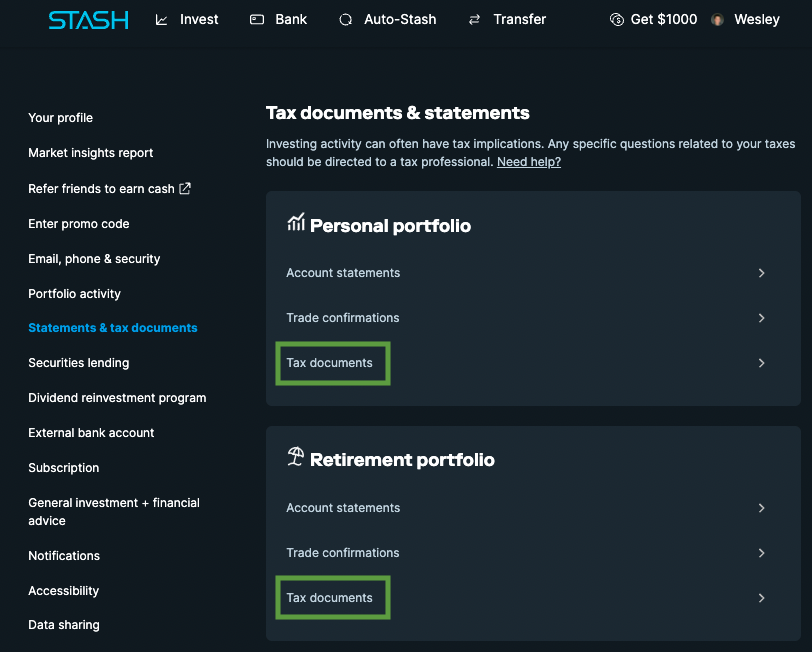

The tax documents are released in the month of February the year after the account is opened. You likely wont have tax documents if. The easiest way to do this is through the Stash app under SettingsStatements and DocumentsTax Documents.

The Company proposes a return on investment based on a weighted average cost of capital WAGG of 6707 percent based on the Boards Order in Elizabethtowns last base rate case proceeding in Docket No. Stash will email you when your tax forms become available. Stash will make your relevant tax.

2019 Tax Documents Now Available. This is a tax form that consolidates all appropriate 1099 forms for your Stash Invest account into one single form. Firm Details for STASH INVEST Location.

1099-DIV 1099-B etc at the top of pg. Every parent wants to put their children in the best position for success. Acorns does not provide tax or legal advice.

You received dividend payments greater than 10 from your Stash Invest investments in 2021. I just checked my account and tax documents are finally available for 2019. You sold an investment in your Stash Invest account in 2021.

Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser. Stock not yet received may receive tax treatment less favorable than that accorded to dividends. This form is relevant for all Stash investors who invested in certain ETFs even if you no longer hold this investment.

So if the account was opened in summer of last year the first tax statement is prepared in February of this year. You sold an investment in your Stash Invest account in. Stash will make your relevant tax documents available online in mid February.

Applicable Rules and Regulations. Many other robo-advisors offer tax-loss harvesting which is an investment strategy that can reduce the amount of. You received dividend payments greater than 10 from your Stash Invest accounts in 2021.

Carter Phillip Gifford PESA ADRIEN. Will I Have Tax Documents from Stash. Take a few minutes to read our community guidelines.

Its under Statements and Tax Documents once you click on your name at least on Desktop. You made a withdrawal from your Stash Retire IRA of 10 or more or. Parents strive to give their children the best education best healthcare and best upbringing that they can provide to.

Stash does not offer any form of tax strategy. It says they may not be posted until February. You should receive a 1099 summary form from Stash which will reflect any interest or dividends earned as well as whether any investment products were sold or traded.

You may be eligible to receive a 1099 form if your investment activity with Acorns last year meets IRS report. Come talk about Stash investing and personal finance. The Corrected Consolidated 1099 form replaces any other 1099s made available to you previously.

This was my first year trading etrade and robinhood both say Feb 15th. You should consult with a tax or legal professional to address your particular situation. So just a heads-up for those of you waiting on this to file your taxes.

External Multistate Tax Alert 01 New Jersey modifies provisions applicable to certain tax credit transfers Overview On January 16 2018 Governor Christie signed Senate Bill 3305 S33051 modifying New Jerseys tax credit transfer provisions under the Grow New Jersey Assistance Act and the Public Infrastructure Tax Credit Program as. You can access historical documents year round Tax Documents section of Account Management. Stash is not a bank or depository institution licensed in any jurisdiction.

You should have tax documents from Stash if. Stash also prepares the relevant tax forms at no cost. All transactions for the Account shall be subject to the constitution rules regulations customs.

You received more than 10 in interest on your Stash Invest account. Stash For Kids is an extension of the Stash tax free investment which has been specifically developed for South Africans under the age of 18 years. For my tax document a lot of Date Acquired box 1b information are.

The 1099-B is a tax form sent to you from Stash so that you can report any gains or losses from selling stocks mutual funds or EFTs during the year. Is a digital financial services company offering financial products for US.

How To Get Your Stash Tax Documents Youtube

Your Stash Account Stash Money Saving Strategies Ways To Earn Money Stash

Online Tax Resource Center Stash

Check The Monthly Account Statement And Balance The Portfolio Affiliate Account Monthly Check Portfol Investing Financial Documents Budget Planning

Online Tax Resource Center Stash

How To Read Your Brokerage 1099 Tax Form Youtube

Paper Organization How Long Should I Keep It Free Printable Clean Mama Paper Organization Documents Organization Work Organization

Turbotax Direct Import Instructions Official Stash Support

Stash Review 2022 Are The Features Worth The Cost

Consider Using This Checklist As You Prepare Your 2021 Taxes Stash Learn

If I Don T Recieve A 1099 B From The Stash App Do I Still Report Anything On My Taxes Stash Website Says That If You Opened Your Account In The Last Year They

Why And How Should You Balance Your Investment Portfolio Investment Portfolio Investing Investing Strategy

Stash App Taxes Explained How To File Your Stash Taxes Youtube

Online Tax Resource Center Stash

Online Tax Resource Center Stash

Employment Pay Stubs 101 Is My Employer Required To Give Me A Pay Stub Small Business Tax Deductions Business Tax Deductions Deduction